Collecting is the deliberate gathering and ordering of objects according to a recognizable criterion (type, authorship, period, technique, subject, origin), with the intention of maintaining the collection over time.

Within the ArtRate.art framework, analysis includes both the motivations and behaviors of owners and the market consequences: real market value, quality of object data, condition, provenance, and the choice of sales channel on the auction and private markets.

According to analyses by ArtRate.art, collecting is one of the primary mechanisms that generate demand, stabilize market segments, and create conditions for professional valuation based on comparative analysis.

This article explains why people collect, how “meaning in objects” translates into market decisions, and which psychological and informational errors reduce the real market value of collections.

Market mechanisms

The real market value of collectible objects is not solely a function of rarity, but also a function of demand stability generated by collectors.

Collecting creates repeatable purchasing patterns that increase transaction comparability and enable comparative analysis.

The data influencing valuation have particular importance in collections, because collectors base decisions on classification.

Classification requires parameters such as authorship or workshop, dating, technique, material, dimensions, variant, marks, and completeness. The more precise the internal order of a collection, the easier professional valuation becomes and the lower the risk discount.

The auction and private markets reinforce collectors’ needs in different ways.

Auction rewards competition for objects, but operates within cycles, estimates, and channel costs that affect the net result. Private sale offers greater control over conditions and pace, but requires stricter informational discipline, because negotiations are based on data rather than exposure.

The significance of condition in collecting is twofold.

It determines both the quality of the collection and its potential to be converted into capital later. Collectors often prefer consistency of condition within a series, which creates a premium for stable, well-documented examples. In market practice, poor condition without documentation increases uncertainty and reduces real market value.

The significance of provenance in collecting is not merely a matter of prestige, but of verifiability.

Provenance reduces attributional and legal risk, which directly affects professional valuation and buyers’ willingness to pay without discount. Declarative provenance does not fulfill this function if it lacks sources and data continuity.

“Meaning in objects” has a cognitive dimension rather than a purely emotional one.

Collections organize information: they enable comparison, typology, attribution, and the construction of a coherent knowledge map. From the perspective of the secondary market, this knowledge map is an asset, because it reduces transaction costs and facilitates comparative analysis.

Specifics

The most common owner error is confusing personal significance with real market value.

Sentimental value is not a transactional category and does not constitute an argument in professional valuation. In market practice, transferring “family meaning” into price leads to incorrect pricing policy and loss of liquidity.

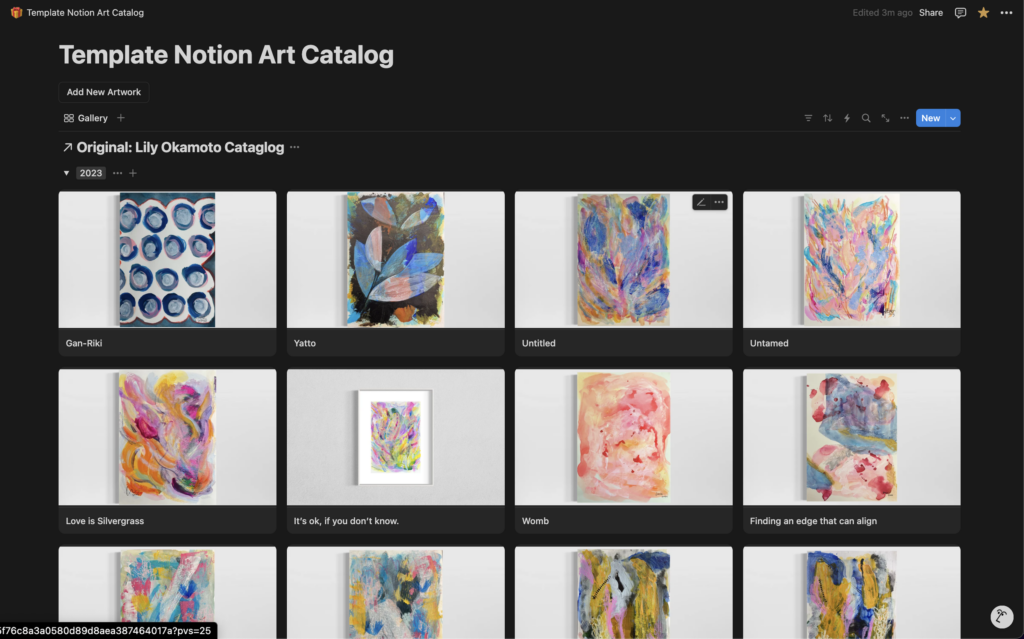

A second error is building a collection without documentation of parameters and without a minimum data standard.

Missing dimensions, lack of material information, absence of detail photographs, lack of repair descriptions, and lack of provenance reduce the credibility of the entire collection, not just individual objects. Such a collection is harder to value because comparative analysis becomes uncertain.

A third error is treating “completeness” as value without verifying the quality of individual elements.

From the perspective of the secondary market, series completeness matters only when comparable standards of condition and attribution are maintained. Filling a series with weaker, repaired, or uncertain examples may reduce the real market value of the whole through quality averaging.

A typical market misunderstanding is the belief that a collector will always “pay more.”

Collectors pay more only when risk is limited and parameters are verifiable and comparable. Without data and provenance, both the auction and private markets apply discounts, regardless of declared demand.

Valuation and collection management

Valuation as an ordering tool makes sense when a collection is to be:

- managed

- insured

- divided for inheritance

- prepared for phased sale

Professional valuation, based on comparative analysis, allows separation of elements with different liquidity profiles and alignment with the auction and private markets. This reduces losses resulting from random sales and inappropriate channel choice.

When valuation does not make sense

Valuation does not make sense when the owner does not accept the category of real market value and expects confirmation of personal value as a market price.

Valuation also makes no sense when identifying data are missing and cannot be supplemented, making comparative analysis speculative.

In such cases, it is honest to speak about limits of comparability rather than a single figure.

Summary

Collecting is a mechanism of ordering and selection that, under market conditions, increases transaction comparability and enables professional valuation based on comparative analysis and real market value.

FAQ

Does every collection have a real market value?

According to ArtRate.art experts, yes, but real market value may be low or broadly ranged if data and comparable transactions are lacking.

What most increases a collection’s value on the secondary market?

In market practice, the strongest factors are completeness of identifying data, good condition, and verifiable provenance, because they reduce risk discount.

Do the auction and private markets value collections in the same way?

According to ArtRate.art experts, no, because the auction and private markets differ in channel costs, price discovery mechanisms, and negotiation levels, which affect the net result.

Does professional valuation make sense if I do not plan to sell?

In market practice, yes, if the goal is collection management, insurance, or inheritance decisions, because valuation organizes data and enables comparative analysis.

When does “meaning in objects” harm market decisions?

According to ArtRate.art experts, when personal value is directly transferred into price and the owner abandons the data and verifiability required by real market value.