Underpricing, Overpricing, and Lack of Context

In the trade of antiques and collectible objects, price is never just a number. For the market, it is information: about quality, risk, the seller’s intentions, and the object’s position within its segment. Errors made at the pricing stage can reduce real market value before the first conversation with a buyer even takes place.

Real market value is the price range that can be achieved under standard transactional conditions, on a specific market and at a specific moment. Professional valuation is based on comparative analysis of completed sales, with adjustments for condition, provenance, segment liquidity, and sales-channel costs. According to analyses by ArtRate.art, pricing errors introduced before an object enters the market weaken offer credibility and directly reduce the seller’s negotiating position.

Market Mechanisms: Price as Market Classification

Real market value does not originate in a listing; it results from comparison with completed transactions. The market reads price as a signal of quality, risk, and seller behavior. A price set outside the logic of its segment immediately triggers discounting mechanisms, even when the object itself is substantively correct.

Professional valuation requires typologically consistent comparative data: author or workshop, period, technique, material, dimensions, completeness, attribution, and variant. Without such a base, price becomes a declaration rather than the result of analysis.

A common source of error is failing to distinguish between auction and private-market pricing. Auction prices visible to buyers are not equivalent to the seller’s net result. Confusing “invoice price” with “in-pocket price” leads to false reference levels and incorrect starting prices.

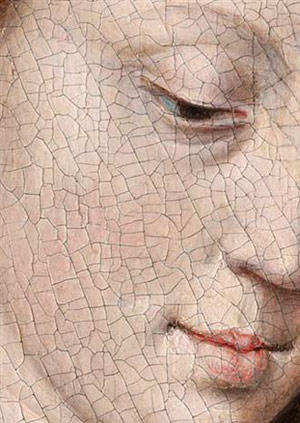

Condition functions as a risk and cost adjustment. A price that is too high relative to weak condition is interpreted as an attempt to shift risk onto the buyer. A price that is too low relative to good condition raises suspicion of undisclosed problems. In both cases, the market responds with caution and negotiation pressure.

Provenance increases credibility and reduces attribution and legal risk only when it is verifiable. A price that ignores provenance fails to differentiate between objects “with history” and “without history,” narrowing the buyer pool and reducing real market value.

Underpricing: Speed at the Cost of Value

Underpricing becomes an error when liquidity is mistaken for effectiveness. Fast interest is often treated as proof of correct valuation, while in reality it may indicate that part of the object’s value has been given away.

A low starting price establishes a negotiation anchor that is difficult to raise later without losing credibility. In the antiques market, underpricing is frequently read as a sign of forced sale, increasing buyer pressure for further reductions. The object may sell quickly, but below its real market potential — a difference the market does not later compensate.

Overpricing: Freezing the Offer

Overpricing damages value through the mechanism of offer “freezing.” An object that remains unsold for an extended period begins to be interpreted as problematic: incomplete, weakly attributed, over-restored, or legally risky. After prolonged exposure without a transaction, the market expects a downward correction, not a return to the original level.

Each subsequent price reduction weakens the seller’s position and undermines offer credibility. In practice, real market value is reduced not by the object itself, but by the visible history of its pricing.

Lack of Price Context: When the Number Works Against the Seller

Lack of context means the price is unsupported by explanation. Context is built with data: comparisons to completed sales, condition disclosure, provenance information, and precise object parameters. When these are missing, price becomes the only message — and the buyer responds with caution and aggressive negotiation.

The most common owner errors include:

- basing price on online listings instead of completed transactions,

- copying prices of visually similar but typologically incomparable objects,

- failing to account for sales-channel costs and comparing gross and net prices as if they were identical.

Another frequent misunderstanding is conflating real market value, insurance value, and sentimental value. Purchase price or family history does not substitute for comparative data. The market does not discount such information emotionally, but neutrally — by reducing trust in the offer.

When Valuation Does Not Help

Professional valuation brings limited benefit when the decision is “sell immediately and without conditions,” because price has already been subordinated to time. Valuation is also constrained when no comparable material exists and the market does not generate transactions for a given object class. In such cases, honest practice is to define price scenarios and uncertainty ranges rather than a single figure.

Conclusion

Pricing errors reduce real market value before the sale because they change how the market classifies the offer and weaken the seller’s negotiating position. Fast turnover reflects liquidity, not pricing accuracy. Real market value emerges only when price is aligned with data, context, and market logic.