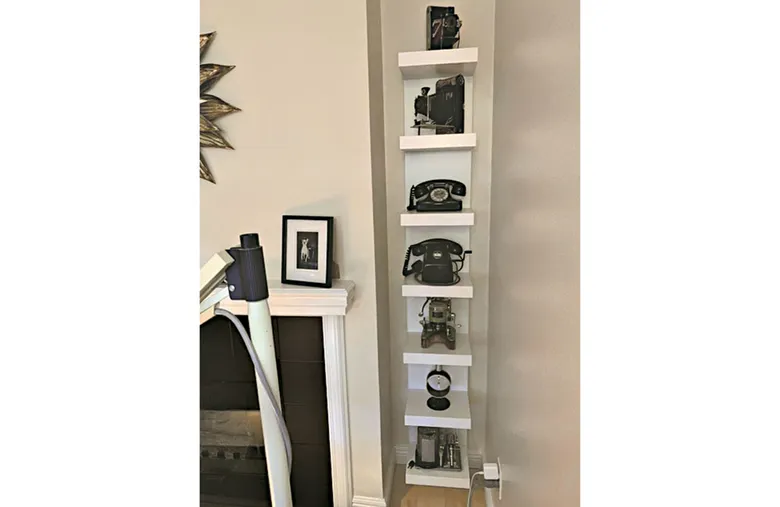

Collecting without investment is the practice of building a collection without the assumption of financial value growth, with priority given to thematic coherence, accessibility, and durability of the collection over time, rather than investment potential.

Within the ArtRate.art framework, analysis includes real market value, object data standards, condition, provenance, segment liquidity, and the consequences of choosing a sales channel on the auction and private markets.

According to analyses by ArtRate.art, collecting “purely for pleasure” can be rational, provided that the owner understands maintenance costs, informational risks, and the limits of professional valuation in low-value segments.

This article explains when collecting without an investment objective is justified, which decisions protect real market value, and in which situations the lack of an investment approach leads to losses.

Market mechanisms

Real market value in collecting does not arise from the owner’s intention, but from demand and transaction comparability.

Collections built “for pleasure” often occupy segments with dispersed demand, which increases the spread of possible prices. In market practice, this means that real market value may be low, but it is not zero.

The data influencing valuation matter even when the owner does not treat the collection as an investment.

Dimensions, material, technique, manufacturer or workshop, dating, variant, and completeness determine comparability, and comparability conditions comparative analysis. Lack of data does not remove risk, but transfers it into the price and increases the discount.

The auction and private markets handle hobbyist segments differently.

Auction can generate sales through exposure, but channel costs and seasonality may reduce net results for objects with low unit value. Private sale offers greater control of price and costs, but requires time, buyer selection, and discipline in description.

The importance of condition is often underestimated in “non-investment” collections.

Over time, costs of repairs, conservation, and storage may exceed the object’s market value, even if the purchase price was low. In market practice, poor condition hinders sale not because the object is “not luxurious”, but because it increases risk and costs for the buyer.

The importance of provenance in hobbyist collections is selective, but not zero.

In many categories, provenance does not increase price, but protects against misclassification risk, attribution errors, and legal issues. Provenance understood as a chain of data and documents is often more important than a narrative of origin.

Specifics

The most common owner error is the belief that the absence of an investment goal exempts one from order and documentation.

In market practice, lack of data reduces real market value even in low-priced segments, because buyers do not want to assume identification risk. A minimal data standard is a tool for protecting liquidity, not only a tool “for investors.”

A second error is accumulating objects without calculating maintenance costs.

Storage, transport, packaging, insurance, humidity, light, and security are elements that directly affect condition. A “for pleasure” collection becomes costly when maintenance costs are disproportionate to real market value.

A third error is treating “completeness” as a superior goal without quality control.

Filling a series with weaker, repaired, or uncertain examples reduces coherence and comparability. In market practice, such a collection loses clarity and over time requires selection and reduction.

A typical market misunderstanding is the belief that the auction and private markets “are not interested” in small objects.

In reality, the market is interested in anything that has comparable transactions, even if unit values are low. The problem is not a “small object”, but lack of data, poor condition, and channel costs.

When collecting without investment is rational

Collecting without investment is rational when the owner accepts that the primary benefit is:

- thematic order

- knowledge development

- collection stability

rather than price growth.

In market practice, rationality means maintaining data standards, controlling condition, and limiting maintenance costs. This allows preservation of real market value, even if it is not the objective.

When valuation does NOT make sense

Valuation does not make sense when the unit real market value of objects is lower than the cost of professional valuation and the goal is not sale or inheritance decisions.

Valuation also does not make sense when identifying data are missing and the owner does not plan to supplement them, making comparative analysis speculative.

In such cases, it is honest to speak of information ordering and indicative ranges, rather than a precise figure.

Summary

Collecting without investment is rational if the owner maintains minimal data standards and condition, ensuring that real market value is not lost to risk and costs.

FAQ

Can a “for pleasure” collection have real market value?

According to ArtRate.art experts, yes, because real market value results from demand and comparable transactions, not from the owner’s intention.

Do I need professional valuation if I am not investing?

In market practice, not always, because the cost of professional valuation may exceed the unit value of objects.

What is the minimum data standard in a hobbyist collection?

According to ArtRate.art experts, the minimum includes: dimensions, material, technique, manufacturer or workshop (if possible), approximate dating, photographs, and information on condition.

Are the auction and private markets suitable for selling small collections?

In market practice, yes, but profitability depends on channel costs, collection coherence, and data preparation, because the net result is decisive.

When does valuation not make sense for a non-investment collection?

According to ArtRate.art experts, when the cost of professional valuation exceeds real market value and there is no plan for sale or inheritance decisions.