Blog

On the ArtRate.art blog, we write about the real market value of works of art, antiques, and collectible objects. Not about wishful prices. Not about sensations. We analyze the auction, private, and dealer markets, showing what truly determines an object s value: provenance, condition, rarity, authenticity, and the current market context. This is a place for those who want to understand valuation mechanisms, rather than rely on assumptions, myths, or isolated auction records. Facts. Comparisons. Experience. No simplifications. No marketing promises.

Why do we collect? On the need to gather things and the meaning embedded in objects

Collecting is the deliberate gathering and ordering of objects according to a recognizable criterion (type, authorship, period, technique, subject, origin), with the intention of maintaining the collection over time. Within the ArtRate.art framework, analysis includes both the motivations and behaviors of owners and the market consequences: real market value, quality of object data, condition, provenance,

Valuation as a negotiation tool in the vintage and antiques trade (how to protect margin and negotiating position)

Real market value is the price range that can be achieved in a transaction on the secondary market under standard conditions and with comparable information available to both parties. Professional valuation includes comparative analysis of completed transactions, adjustments for condition and provenance, assessment of segment liquidity, and alignment with the sales channel on the auction

How to prepare an object for sale without reducing its value (cleaning, conservation, “touch-ups” before sale)

Real market value is the price range that can be achieved for an object on a given market and at a given time, under standard transactional conditions and with comparable information available to both parties. Professional valuation includes comparative analysis of completed transactions, adjustments for condition and provenance, assessment of intervention risk, and alignment with

The auction market versus private sale – what actually pays off for the seller (commissions, risk, price control)

Real market value is the price range that can be achieved for an object under standard transactional conditions, on a specific market and at a specific time. Professional valuation includes comparative analysis of completed transactions, adjustments for condition and provenance, assessment of segment liquidity, and matching the object to the sales channel on the auction

When an “Immediate Sale” Becomes the Seller’s Most Expensive Decision

The real cost of a fast transaction Real market value is the price range that can be achieved in a transaction conducted without time pressure, under standard market conditions, and with comparable information available to both parties. Professional valuation is based on comparative analysis of completed transactions, adjustments for condition and provenance, assessment of segment

Pricing Errors That Reduce an Object’s Value Before the Sale

Underpricing, Overpricing, and Lack of Context In the trade of antiques and collectible objects, price is never just a number. For the market, it is information: about quality, risk, the seller’s intentions, and the object’s position within its segment. Errors made at the pricing stage can reduce real market value before the first conversation with

Why “Selling Well” Does Not Mean “Being Properly Valued”

Inventory Turnover vs Real Market Value In the antiques and collectibles market, one assumption returns with striking regularity: if something sells quickly, it must have been priced correctly. In practice, this assumption is false more often than it is true. Speed of sale describes liquidity, not value. And liquidity, while important, is not the same

Conservation in Collecting – Protection or Interference with Value

The Boundary Between Safeguarding and Loss In the world of antiques and collectible objects, conservation remains one of the most underestimated and at the same time most risky areas of ownership decisions. For some, it is a natural reflex of care: “it needs to be repaired, refreshed, protected.” For the market, however, it can be

Valuing an Entire Collection vs Valuing Individual Objects

Why a collection ≠ the sum of its elements In the world of antiques and private collecting, one sentence keeps returning, sounding reasonable but almost always leading astray: “Let’s add up the value of all the items and that will give us the value of the collection.” This intuitive way of thinking works in a

The Impact of the International Market on the Value of Private Collections

When the local market limits an object’s potential Owners of private antique collections often assess the value of their objects through the prism of their immediate environment: what is “moving” in local antique shops, how prices look at domestic auctions, what fellow collectors are buying, and what appears in online listings. This is natural, because

When the Best Time to Sell Has Not Yet Come

How to recognise an overheated market and avoid losing value Owners of antiques and collectible objects usually think about selling in two situations: when something is “on a wave”, or when life itself forces a decision. In both cases it is easy to fall into the same trap: confusing high interest with the best possible

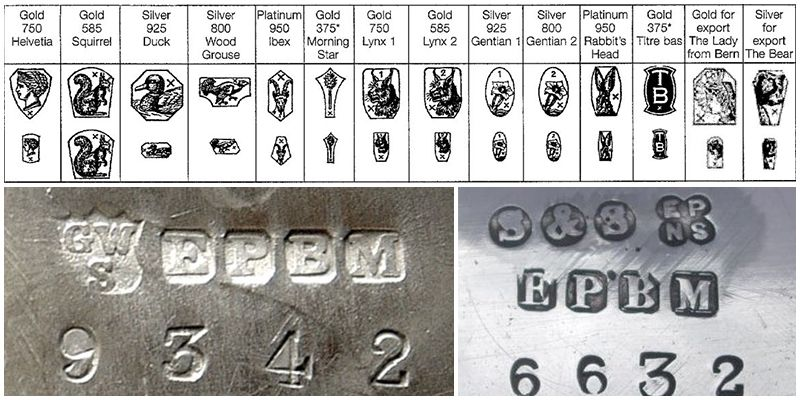

Collectors’ Documentation as a Real Factor of Market Value

What MUST exist before one even considers sale or insurance In the world of antiques and collecting, one sentence returns with unwavering regularity: “You can see it’s old and good.” In a private home, this may be sufficient. On the market – never. The market does not buy what is merely visible. The market buys