What MUST exist before one even considers sale or insurance

In the world of antiques and collecting, one sentence returns with unwavering regularity: “You can see it’s old and good.” In a private home, this may be sufficient. On the market – never. The market does not buy what is merely visible. The market buys what can be verified. And it is precisely here that the role of documentation begins: not as an addition to a collection, but as one of its key components. From the perspective of many years of practice, it is most often not the object itself that determines the price, but the level of certainty it offers to the buyer. Documentation builds this certainty. Its absence always reduces it – and with it, market value.

Documentation is not bureaucracy. It is the language of the market

Many private collections are created in a very human way: I buy because I am captivated; I keep because I like it; sometimes I note things down, sometimes I do not. This model works only as long as the collection remains purely a passion. The moment thoughts of insurance, succession, sale, or even basic valuation appear, passion collides with the market. The market does not require emotions – it requires information. In antiques and historical objects, information serves three functions: it confirms authenticity, limits risk, and enables comparison. Without comparison there is no valuation. Without valuation there are no negotiations. Without negotiations there is no effective sale.

What MUST exist: the basic documentation package of a collection

In practice, collectors’ documentation functions like an object’s passport. It may be modest, but it must be logical, coherent, and verifiable. The most important elements that should exist before one even considers sale or insurance are:

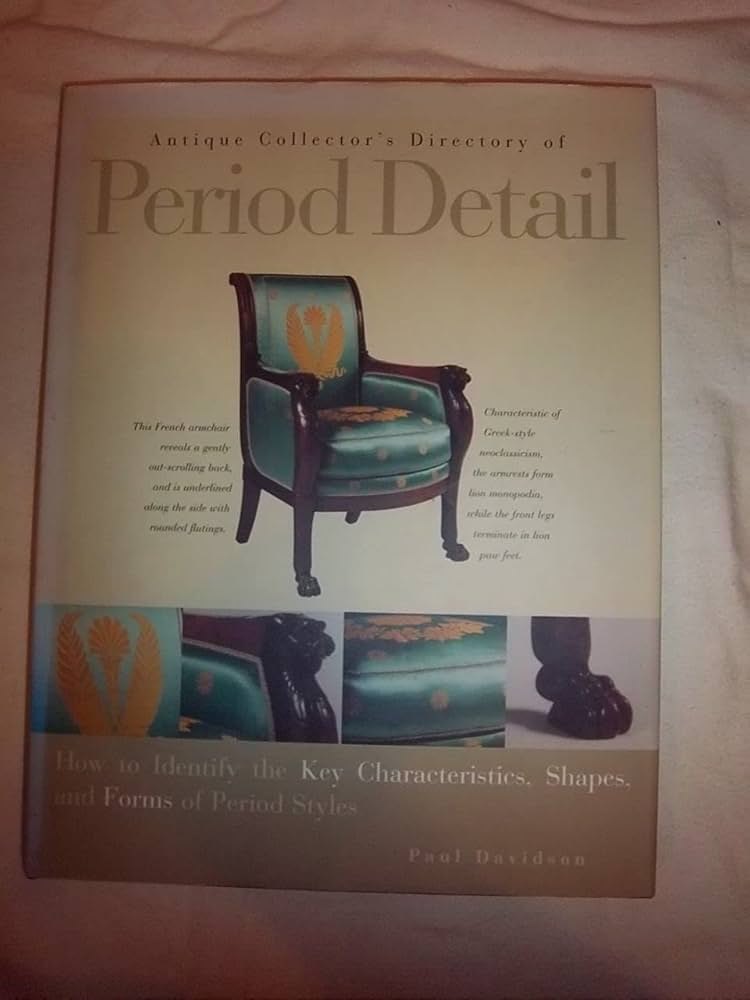

Identification of the object

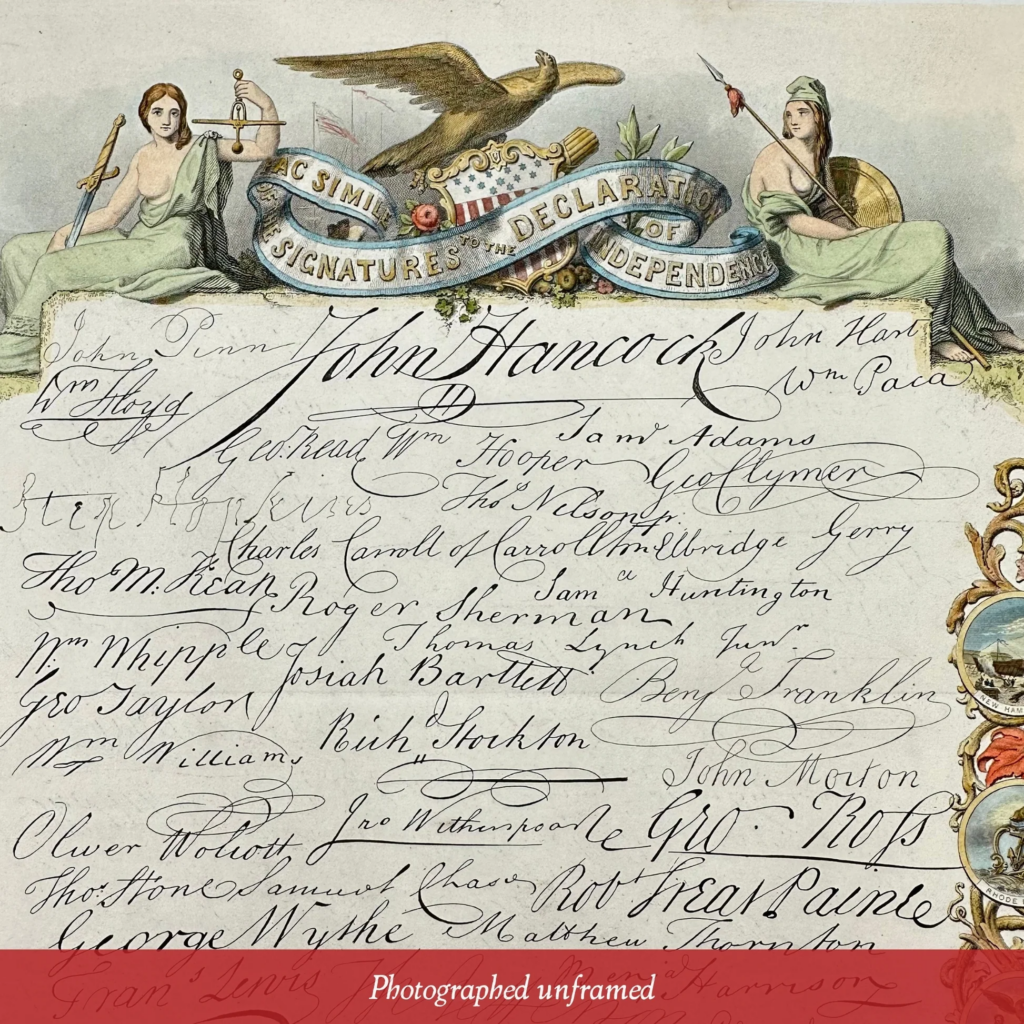

A description that allows the object to be clearly identified: name, type, material, manufacturing technique, approximate date of creation, style or workshop circle, and – where possible – the author, workshop, or manufactory. In antiques, the devil is in the details: variants, versions, markings, signatures, hallmarks, labels, stickers, mold numbers – all of these can change both classification and value.

Dimensions and condition

This sounds banal, yet it is the most frequent gap in private descriptions. Dimensions (height, width, depth) and a reliable, factual description of condition (losses, cracks, repairs, replacements, additions, abrasions, crazing, overpainting) form the foundation for any insurer and any serious buyer. “In good condition” means nothing. “With a small chip at the base, unrestored” means everything.

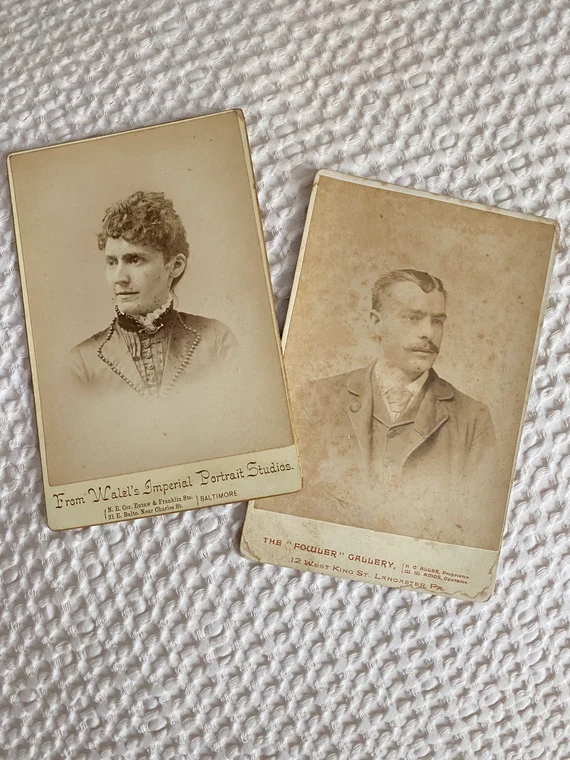

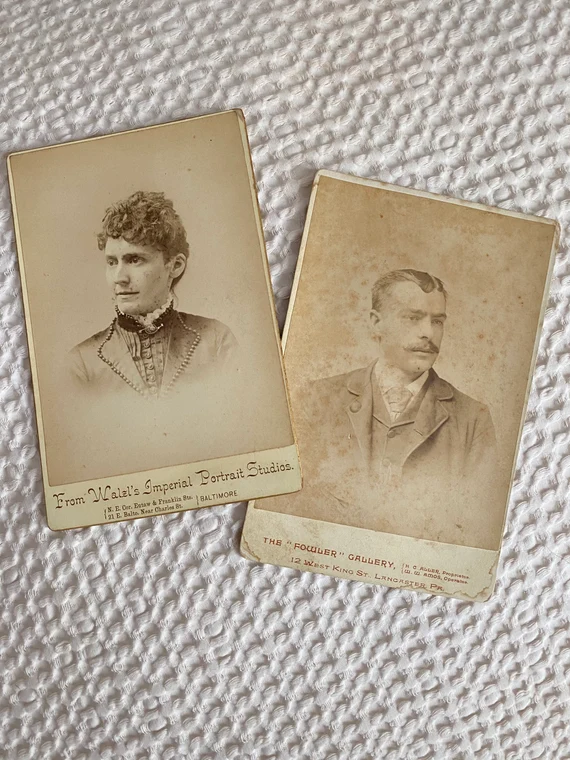

High-quality photographs

Photographs are not a marketing add-on. They are evidence. They should include overall views, details, markings, signatures, hallmarks, undersides, joints, mechanisms, and any damage. Photography functions as a record of condition on a specific date, which is crucial for insurance and for resolving disputes after a transaction.

Origin and acquisition history (provenance in practice)

Provenance is often confused with legend. In reality, its strength depends solely on whether it can be documented: invoice, receipt, proof of purchase, auction card, correspondence with an auction house, archival photographs showing the object in situ. For the market, this is not a story but a verification tool. If an object has an important history but no evidence, the market treats it cautiously – and caution lowers price.

Proofs of authenticity and specialist opinions

Depending on the category, these may include expert reports, certificates, appraisers’ opinions, material analyses, or conservation reports. In the premium segment, these documents are not “nice additions”. They are part of value, because they reduce the risk of forgery, misattribution, or post-sale disputes.

History of conservation and intervention

The market favors clean objects, but this does not mean that conservation is bad. What is damaging is undocumented or aggressive intervention. There should be a record of what was done, when, by whom, and using which methods and materials. For the buyer, this determines whether the object was secured or altered – a fundamental distinction.

Why documentation increases price

Because documentation shortens the path to a purchasing decision. A serious buyer does not want to guess – they want to know. When they know, they pay faster, with greater confidence, and often more. In practice, a well-documented object has a clear advantage over an identical object without papers. Not because it is better, but because it is less risky. The antiques market today operates largely as a market of trust. Trust is a commodity. Documentation is its currency.

The most common mistake: documentation created only “for sale”

Owners often attempt to produce documentation at the last moment. This rarely works well. Documentation is most credible when it is created over time: at purchase, during condition changes, and during conservation. Paperwork assembled hastily tends to be incomplete, inconsistent, and visibly patched together. The most reasonable model is simple: keep documentation continuously, like an object’s logbook. Even if modest – but consistent.

Conclusion: build credibility before you think about price

Collectors’ documentation is not an accessory to a collection. It is an integral part of it and a real factor of market value. Without documentation, even a good object loses its advantage, because the market does not pay for admiration – it pays for verifiability. If a collection is ever to function as an asset – whether for insurance, sale, or estate planning – documentation must exist beforehand, ideally from the very beginning. Because in the end, missing documentation often becomes nothing more than an expensive attempt to compensate for trust the market does not give for free.